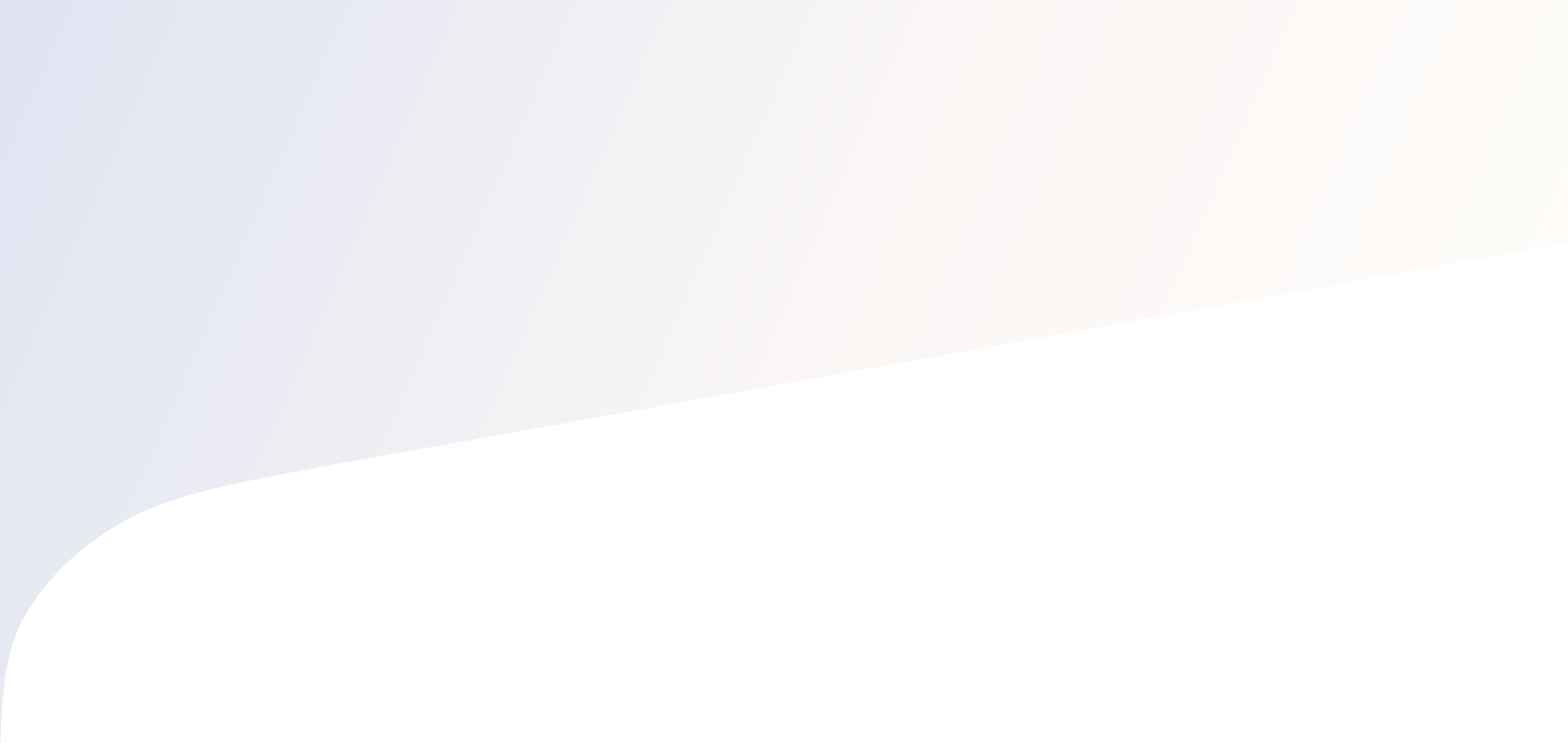

SaaS are stealing market share from banks

SaaS are stealing share from banks in a massive way. Banks and traditional acquirers have lost 26% of card processing volumes to new entrants in just the last 5 years. How did this happen? One key reason is that vertical SaaS+payments is now the best distribution model for reaching SMBs. Banks need to evolve to win in embedded payments, or get ready to lose more.

Embedded payments are the future of payments

It used to be that you could run a successful small business with a calendar, a phone, and a standalone terminal. Now a small merchant runs their business with a SaaS solution specific to their vertical.

Small businesses choose that vertical-specific software first -- with huge ramifications.

As our friends at ScanSource put it - that core vertical software choice defines the IT needs of the small merchant for the next five years! Those small businesses want solutions that "just work from day one" with their main software system. The expect to buy it all integrated and from one provider, so it works seamlessly, has one price, and is fully supported.

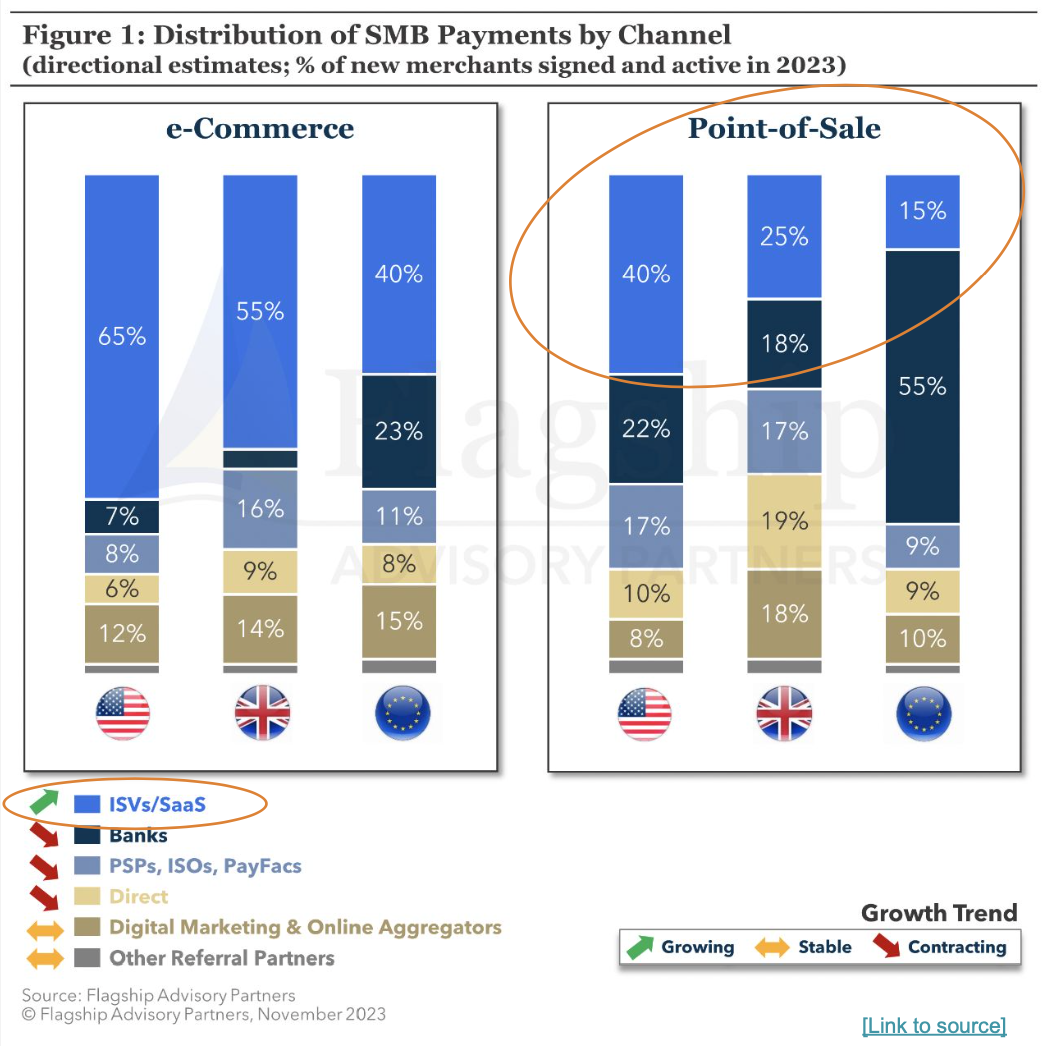

Payments is no exception. Merchants want to buy payments from their SaaS provider. Vertical SaaS has become a dominant channel for new payments sales in the US and UK.

Now every acquiring bank is chasing an embedded payments tech stack in order to win SaaS companies (who sell payments the way that small businesses want to buy them) and stop the bleeding.

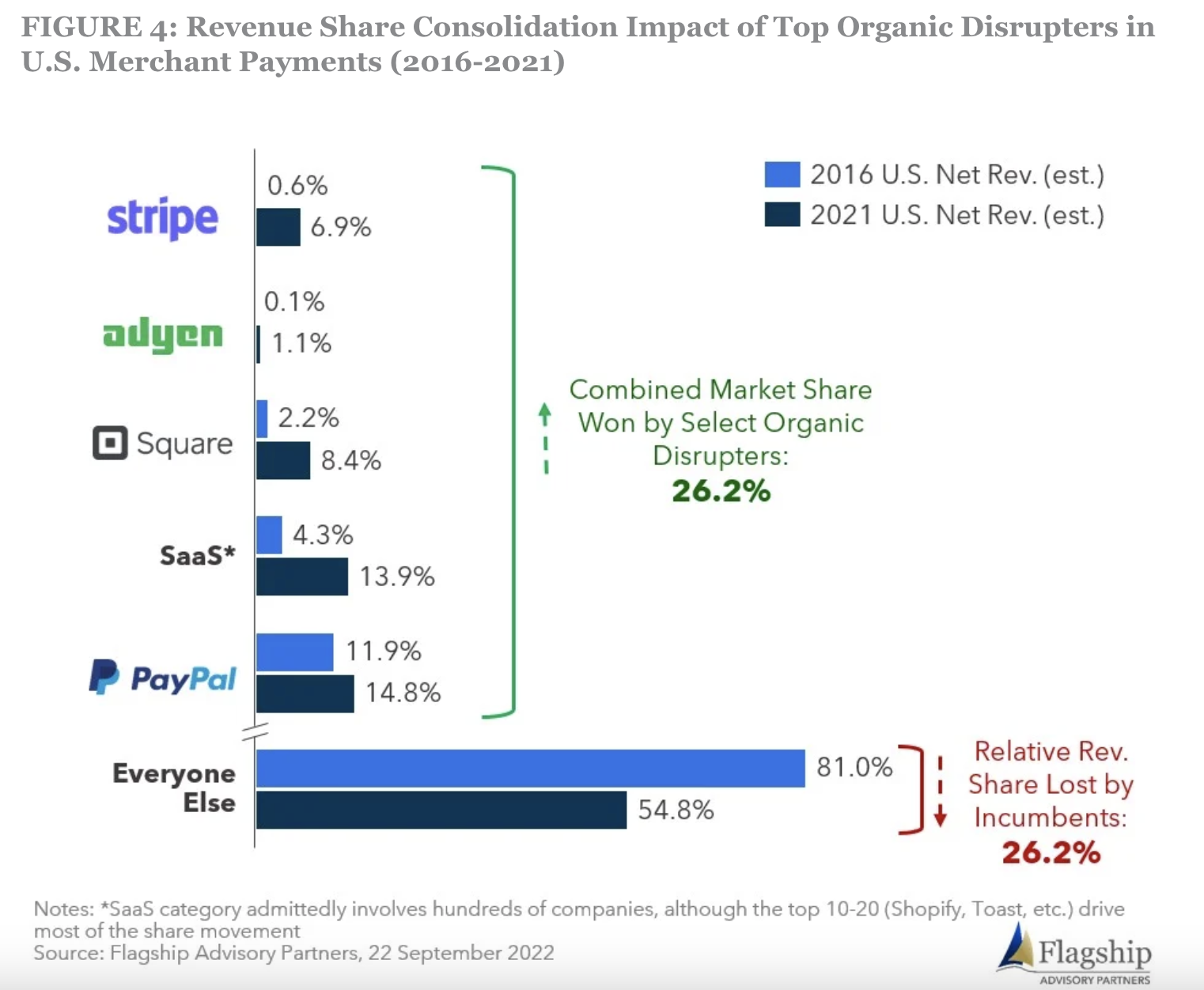

Evolution of software revenue models

But just because this trend of SaaS+payments is new to banks, doesn't mean that payments are new to SaaS. Quite the contrary. There is a common evolution in SaaS and payments, where SaaS companies take greater and greater ownership of their payments stack and monetization, with a hockey stick impact on their valuation. This is so common that Bessemer Venture Partners calls indirect monetization of payment volumes part of the new "first act" for SaaS.

This legacy has huge implications for banks going after embedded payments: almost every SaaS prospect for embedded payments already has NON-embedded payments. Likely to the tune of hundreds or thousands of merchants.

Why does this matter? Winning these SaaS players means having payments solutions that will both win both go-forward merchants AND convert their existing merchant base. A bank's offering has to meet the new merchants' needs AND offer a much higher value to the current merchants to drive switching.

With 80% of payments still occurring in person, innovative card present payment solutions are key. But as we have talked about elsewhere, card present is not easy. The use cases vary so much - fixed or mobile? Attended or unattended? Android or Windows POS? And if you are trying to win vertical SaaS companies who are by definition specialized for a vertical, one terminal will not fit all.

The temptation is to lack any card present strategy and just see what business comes in. But this is a dangerous temptation to avoid in card present. With an average certification taking 6-9 months, requiring customers to do their own EMV certification before they can board merchants is a proven way to delay revenue generation. And "open" processing platforms can spend many millions accidentally by managing EMV L3 certifications, most of which deliver no new value. One look at the 1,000+ certified EMV solutions listed in the TSYS VAR Solutions Catalog should make any new embedded payments provider shudder.

But even having a lot of different terminals is not enough to win at embedded card present. Vertical SaaS succeed because they unify everything - data, workflows, and more. Your card present platform needs to level up and do more.

3 key factors for winning at embedded card present

Banks chasing the move to embedded payments distribution need a card present strategy and a platform to match. Verticalized SaaS are sophisticated at integrated payments, are highly specialized, support many merchants today, and want to scale quickly.

In our experience, there are 3 key factors that will determine if a card present platform sets you up for success in embedded payments. Below we outline the 3 key factors, and offer just a few examples of what Handpoint provides to help you succeed.

Factor 1: Dedication to Vertical SaaS

- APIs for every OS/platform and brandable standalones

- Pre-certified, semi-integrated terminals

- PCI-P2PE security

- Brand control over apps and portals

- Unified data from every touchpoint

- Real-time data APIs

- Cloud-hosted support tools

Factor 2: Proven to Convert SMBs

- Leading terminal lines

- Terminals for every use case

- Seamless, simple activations

- Business intelligence, loyalty, and other value-added services powered by payments

- Innovative capabilities: multi-MID, pay-at-the-table, kiosks

Factor 3: Flexible for Future needs

- APIs to link into every part of your platform

- Expansible APIs for ISVs

- Expansible terminal suites

- Ability to add APMs

- End-to-end platform control

- Global reach

- Real-time data

- Support tools

You do not need to build from scratch to have the type of tightly-integrated, value-adding card present platform that lets you win over vertical SaaS. You just have to know that you need one, and contact Handpoint to get a demo.